In some circumstances the taxpayer can elect for the foreign tax to be deducted from the taxable amount in the United Kingdom as an alternative to having a credit for the foreign tax suffered. Tokyo AFP - 10202022 - 0945 Yen weakens to 150 against dollar lowest since 1990.

The State Of The Nation Should Epf Tax Relief Be Reduced Next Year The Edge Markets

2021-12-9Improving Lives Through Smart Tax Policy.

. Offer period March 1 25 2018 at participating offices only. 1 day agoRelief Measure. When we collect.

2022-10-18An inheritance tax is a tax paid by a person who inherits money or property of a person who has died whereas an estate tax is a levy on the estate money and property of a person who has died. UNCDF offers last mile finance models that unlock public and private resources especially at the domestic level to reduce poverty and support local economic development. This relief is applicable for Year Assessment 2013 and 2015 only.

It was 20 prior to that for a full year from 2011 to 2017 which in turn was a result of a progressive raises in the preceding years. Conditional waiver of surcharges for instalment settlement of demand notes for the Year of Assessment 202122 Tax Deduction for Domestic Rent 2022-23 Budget Tax Measures. We dont use your email calendar or other personal content to target ads to you.

With workflows optimized by technology and guided by deep domain expertise we help organizations grow manage and protect their businesses and their clients businesses. 67 Structural policies have been used only modestly with a focus on teleworking and digitalisation. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system.

2020-12-8Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018. IRA and HSA deadlines extended for some. Since then countries have recognized the impact that high corporate tax rates have on business investment decisions so that in 2021 the average is now 2354 percent and 2544 when weighted by GDP.

May not be combined with other offers. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income. 2 days agoThe Group of Seven G7 is an inter-governmental political forum consisting of Canada France Germany Italy Japan the United Kingdom and the United StatesIn addition the European Union is a non-enumerated member.

Tax preferences are policies such as research and development RD credits and patent boxes that reduce the tax burden on digital businesses. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy. 2017-4-6This is either under an applicable tax treaty or UK unilateral relief.

To qualify tax return must be paid for and filed during this period. Tax Accounting. 2020-6-5This is in line with findings from the World Bank SME Support Measures dashboard which suggests that out of 845 SME policy instruments used worldwide 328 relate to debt finance loans and guarantees 205 to employment support and 151 to tax.

Addis Ababa AFP - 10202022 - 1008 Tigray peace talks in South Africa on October 24. Hearst Television participates in various affiliate marketing programs which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. Though most preferences are available for any business some specifically lend themselves to digital business models.

Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. 2022-9-14The UN Capital Development Fund makes public and private finance work for the poor in the worlds 46 least developed countries LDCs. Home page add your press release advanced search about pressbox press release distribution copywriting services email news signup journalist sign up.

2022-10-17Get the latest science news and technology news read tech reviews and more at ABC News. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. Fraud alert text appearing to be from your bank will get your attention but it could be a scam.

Were transparent about data collection and use so you can make informed decisions. The system is thus based on the taxpayers ability to pay. In 1980 corporate tax rates around the world averaged 4011 percent and 4652 percent when weighted by GDP.

IRA and HSA deadlines postponed. Inflation Act includes big changes in energy-related tax credits for homeowners and car buyers. Find many great new used options and get the best deals for DR WHO 1942 CANADA TORONTO ONT TO USA WWII CENSORED STRIP KGVI i12730 at the best online prices at eBay.

Tax relief for Hurricane Ian victims North Carolina and South Carolina. International tax law distinguishes between an estate tax and an inheritance tax citation needed an estate tax is assessed on the assets of the deceased. Malaysia used to have a capital gains tax on real estate but the tax was repealed in April 2007.

Must contain at least 4 different symbols. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make. 2019-6-15Perimeter Intrusion Detection Market Poised to Expand at 143 CAGR During 2018 - 2028.

2022-9-17Outlook puts you in control of your privacy. Its members are the worlds largest IMF advanced economies and liberal democracies. Enabling tax and accounting professionals and businesses of all sizes drive productivity navigate change and deliver better outcomes.

However a real property gains tax RPGT has. California provides tax credits for cannabis businesses. The rules relating to non-doms changed from 6 April 2017.

6 to 30 characters long. 2022-10-17From 1 January 2018 the capital gains tax in Iceland is 22. Free shipping for many products.

The group is officially organized around shared values of. ASCII characters only characters found on a standard US keyboard. We help you take charge with easy-to-use tools and clear choices.

Hearst Television participates in various affiliate marketing programs which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. Tax preferences for digital businesses. Tax relief for Florida victims of Hurricane Ian.

Segala maklumat sedia ada adalah untuk rujukan sahaja.

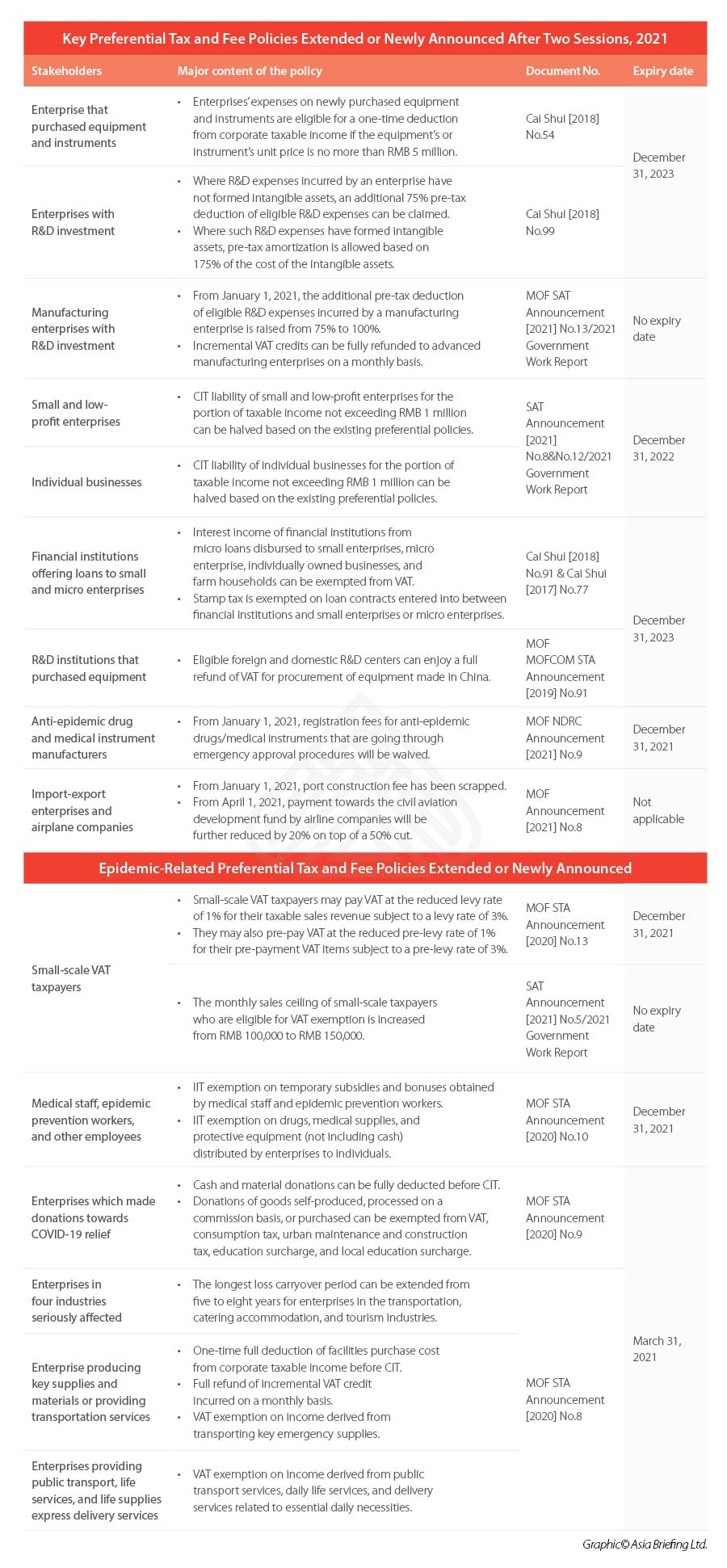

China S Tax And Fee Cuts Extended Or Released After 2021 Two Sessions

3 Property Tax Administration Making Property Tax Reform Happen In China A Review Of Property Tax Design And Reform Experiences In Oecd Countries Oecd Ilibrary

My Personal Tax Relief For Ya 2018 The Money Magnet

Malaysia Personal Income Tax Guide 2020 Ya 2019

Shinee 21ct On Twitter Plz Read Amp Rt Shinee We Would Like To Inform Mini Fundraising Project For Shinee10thanniversary Was Successfully Organized Amp All Funds Was Donated To Irmalaysia On Behalf Of Shinee

Reliefs For Personal Income Tax 2017 Vs 2016 Teh Partners

National Debt Of The United States Wikipedia

Individual Tax Relief For Ya 2018 Kk Ho Co

Tax Relief For Year Of Assessment 2018 Plctaxconsultants

3 12 16 Corporate Income Tax Returns Internal Revenue Service

Income Tax Relief Items For 2020 R Malaysianpf

Rate 0 1 3 8 Individual Income Tax Rates Ya 2018 To Chegg Com

Japan Consumer Price Index Cpi Statista

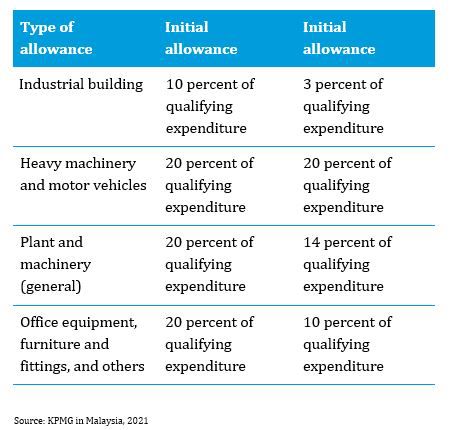

Malaysia Taxation Of Cross Border M A Kpmg Global

New Irs Announces 2018 Tax Rates Standard Deductions Exemption Amounts And More

Best Guide To Maximise Your Malaysian Income Tax Relief 2021

Newsletter 56 2018 Guideline On Income Tax Exemption For Religious Institution Or Organization Under Income Tax Exemption Order 2017 Page 001 Jpg